- Main

- Business & Economics - Investing

- Trading Implied Volatility - An...

Trading Implied Volatility - An Introduction

Simon Gleadall你有多喜欢这本书?

下载文件的质量如何?

下载该书,以评价其质量

下载文件的质量如何?

What is implied volatility? How is it traded? What implied volatility trading strategies are commonly used in the derivatives markets?

These questions and more are examined in this concise introduction to trading implied volatility. This is the 4th volume of the popular Volcube Advanced Options Trading Guides series.

Part I introduces implied volatility. It offers definitions and useful interpretations for implied volatility numbers. Factors influencing implied volatility are discussed. Typical means of trading implied volatility are explained, including options, volatility indices (such as the VIX and related derivatives) and variance swaps.

Part II breaks down the most common implied volatility trading strategies into their main themes. This includes implied volatility trading against historicals, calendar spreads, skew trades, cross-product spreads, volatility arbitrage and compound strategies such as the Dispersion trade. Each strategy is discussed in detail, explaining its aims and major risk factors. This overview should leave the reader well informed as to how implied volatility trading strategies are typically constructed and risk managed.

Both Part I and Part II include a set of exercises with full solutions, to test the reader's understanding of the points raised.

The Volcube Advanced Options Trading Guides are aimed at readers with a basic understanding of simple option terminology who are looking to broaden and deepen their knowledge base. The texts rely on plain, well-written English to explain ideas intuitively and the use of mathematics is kept to a minimum.

These questions and more are examined in this concise introduction to trading implied volatility. This is the 4th volume of the popular Volcube Advanced Options Trading Guides series.

Part I introduces implied volatility. It offers definitions and useful interpretations for implied volatility numbers. Factors influencing implied volatility are discussed. Typical means of trading implied volatility are explained, including options, volatility indices (such as the VIX and related derivatives) and variance swaps.

Part II breaks down the most common implied volatility trading strategies into their main themes. This includes implied volatility trading against historicals, calendar spreads, skew trades, cross-product spreads, volatility arbitrage and compound strategies such as the Dispersion trade. Each strategy is discussed in detail, explaining its aims and major risk factors. This overview should leave the reader well informed as to how implied volatility trading strategies are typically constructed and risk managed.

Both Part I and Part II include a set of exercises with full solutions, to test the reader's understanding of the points raised.

The Volcube Advanced Options Trading Guides are aimed at readers with a basic understanding of simple option terminology who are looking to broaden and deepen their knowledge base. The texts rely on plain, well-written English to explain ideas intuitively and the use of mathematics is kept to a minimum.

年:

2014

出版:

1

出版社:

Volcube

语言:

english

页:

65

系列:

Volcube Advanced Options Trading Guides

文件:

MOBI , 334 KB

您的标签:

IPFS:

CID , CID Blake2b

english, 2014

在1-5分钟内,文件将被发送到您的电子邮件。

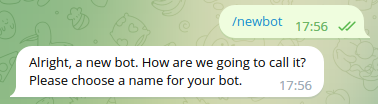

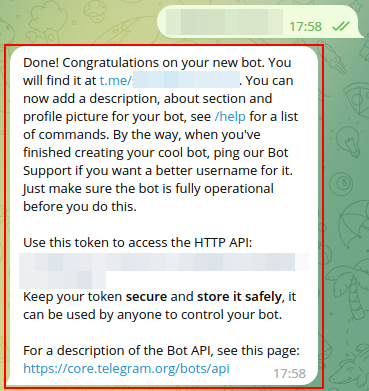

该文件将通过电报信使发送给您。 您最多可能需要 1-5 分钟才能收到它。

注意:确保您已将您的帐户链接到 Z-Library Telegram 机器人。

该文件将发送到您的 Kindle 帐户。 您最多可能需要 1-5 分钟才能收到它。

请注意:您需要验证要发送到Kindle的每本书。检查您的邮箱中是否有来自亚马逊Kindle的验证电子邮件。

正在转换

转换为 失败

关键词

关联书单

Amazon

Amazon  Barnes & Noble

Barnes & Noble  Bookshop.org

Bookshop.org  转换文件

转换文件 更多搜索结果

更多搜索结果 其他特权

其他特权 ![Roy, Rajiv L B [Roy, Rajiv L B] — Option Chain Analysis: The CT Scan of Derivative Market](https://s3proxy.cdn-zlib.se/covers200/collections/userbooks/a058522f69dc3219f405a0be7e672a513c90416af8dcfe3c0f42d48e69635ba0.jpg)